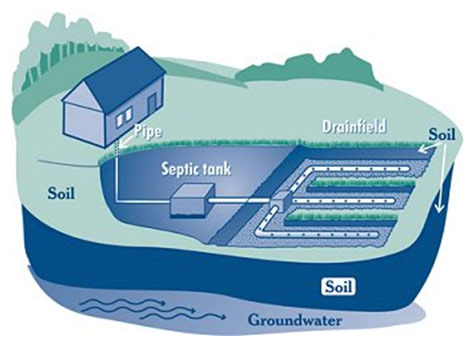

Any owner of a residential property in Massachusetts who occupies the residential property as their principal residence can claim a credit ("Title 5 credit") against personal income tax for certain expenditures associated with the repair or replacement of a failed cesspool or septic system.

The repair or replacement of the failed cesspool or septic system must be made in accordance with the provisions of the State Environmental Code, Title 5.

Who may claim the credit

To claim the Title 5 credit, the taxpayer must be the owner of the residential property, must occupy the property as his or her principal residence, and may not be a dependent of another taxpayer.

An owner is a taxpayer who, alone or together with other persons, has legal title to the residential property. If a residential property has more than one owner who otherwise meets the criteria for claiming the Title 5 credit, each co-owner may claim the credit proportionate to the amount of total qualified expenditures made by each co-owner. The maximum amount of the Title 5 credit that may be claimed by the owner of a residential property is $6000.

The property must be the taxpayer's principal residence.

In general, taxpayers claiming the Title 5 credit will be Massachusetts residents. However, a nonresident owner of Massachusetts residential property who occupies the property as his or her principal residence, and is not the dependent of another taxpayer may claim the Title 5 credit.

For information on replacing failed Septic Systems, contact Morse Engineering and Construction.

Source: mass.gov